Invoicing may sound complicated or tedious, but it is fundamental in your business activity, whether you are a freelancer or a small business owner of a creative agency or an architecture firm.

Learn how to invoice your clients yourself if you don’t want to hire a bookkeeper or freelance accountant to handle your invoices.

We think this guide covers all you need to know about managing your invoices for business to do it yourself without much hassle.

This guide is not meant for accountants—it’s for any freelancer or small business owner who wants to use a business invoicing tool, develop a good system, and keep track of their financial records.

You don’t need a financial background to read this guide. We’ll explain the terminology and concepts, outline step-by-step processes, and share tips & pitfalls to avoid.

It’ll make you want to ditch spreadsheets and Word documents, and we’ll provide a tutorial in Paymo on how to generate invoices digitally and get paid online without much friction.

Disclaimer: This article is for informative purposes only. The content is based on our understanding of finance at the time of publication, and while it is frequently updated, it does not provide legal advice regarding tax law. Please seek independent advice if needed.

Invoicing 101

What an invoice is and isn’t.

Simply put, an invoice is a document listing the goods (e.g., products) or services provided (e.g., hours worked) along with payment terms—total sum and due date—agreed upon between two parties.

Invoices are documents stating the transaction between two entities. Depending on what’s transacted, for example, goods and products, the invoice is between a buyer/customer and a seller.

When it comes to services and hours worked, the invoice is between a client and a provider. Throughout this article, we’ll refer to invoices from a client-provider point of view for brevity.

Invoices are tax documents; depending on the country and type of work—freelancing, entrepreneurship, etc.—they are necessary for bookkeeping. For instance, the IRS requires your invoices, sales slips, account statements, and checks as proof supporting your business transactions.

An invoice in and of itself is NOT a legally binding document, but it may be used as proof if there’s a contract in place. For this reason, an invoice must be detailed and accurate; otherwise, it can be challenged by your client.

When should you use an invoice?

Invoices are not necessary for all types of payment or business. You would not send an invoice if you’ve been paid in full before the start of the project—unless required from the client for their bookkeeping and financial records.

You would not need an invoice in the food, hospitality, entertainment, retail, and e-commerce industries. If these require instant payment, they would most likely not issue invoices.

Invoices are rarely used for one-time payments.

What is the difference between an invoice and a bill?

Technically, these two are not the same, but are similar. The confusion arises primarily because of semantics—white-collar professionals refer to worked hours as “billable hours,” clients often use the broader term to phrase it as, “Send me the bill.” Some invoices use the verb “bill” to address the Client, e.g., “Bill to Client X.”

An invoice is a type of bill, but not all bills are invoices. A bill can be used in almost all industries—from restaurants and spas to online shopping—and can be used for one-time payments. The payment is usually settled immediately, whereas an invoice allows more time for payment.

A bill can be an itemized list of several invoices.

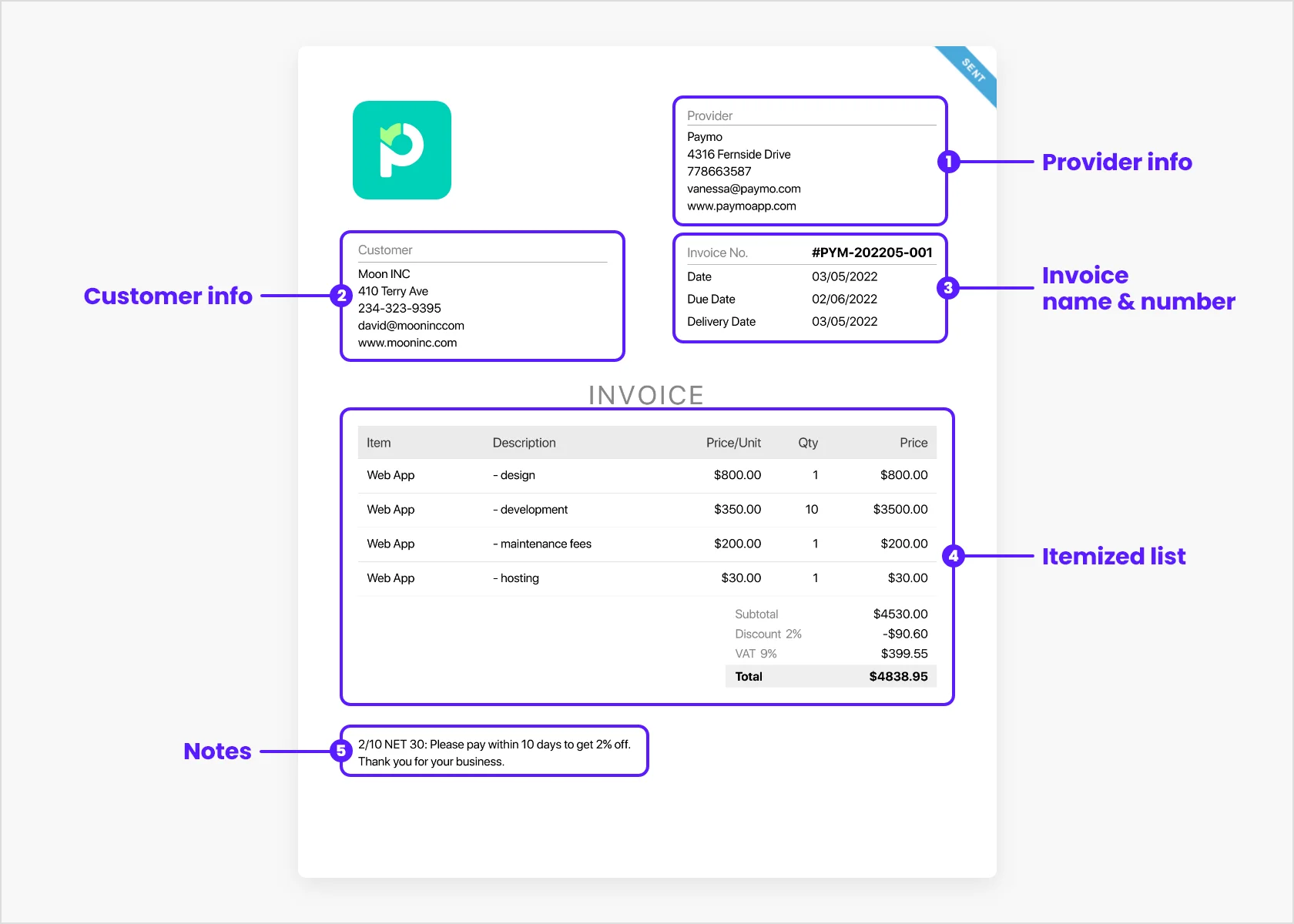

The standard invoice format

Though there is variation among invoices, the standard format of any invoice includes the following: information about the provider and client, invoice number, invoice dates, an itemized list of services, balance due, and payment form. Here’s an example:

Section #1. “Provider Info”

Information about the provider (be it a freelancer or company) includes:

- logo

- full name/business name

- work address

- phone number

- email address

- website

In Paymo, you can order them as you want and even add your Fiscal info for bookkeeping. If you are doing business in Europe and you’re VAT registered, you need to include VAT numbers.

Section #2. “Customer Info”

Information about the client can be as detailed as the provider’s—the bare minimum is the full name, email address, and phone number. Some invoices phrase it as “Bill to Client.”

It doesn’t matter whether the Client is on the right or left side of the invoice. Most businesses opt for the Client on the opposite side of the Provider.

Section #3. Invoice name & number.

Every invoice must be numbered uniquely and logically so that you can organize and track them well. A good rule of thumb is to number them using a combination of letters and numbers. Number them:

- in a sequence, e.g., #INV-0001.

- by adding the date before the sequence, e.g. #INV-[year][month][day]-0001. If it’s too lengthy, estimate how many invoices you’d be sending and see if it makes sense to cross out the [day] or cut down on extra zeros.

- by choosing a letter code that makes sense to you, e.g., #PYM-202205-001. It can be either your business acronym or abjad (e.g., “PYM” for Paymo) or a customer code so that you can keep track of your biggest clients (e.g., “AMZN” for Amazon). The standard letter code is INV for Invoice.

The key is to find the system that works for you and be consistent.

In Paymo, you can create your own Invoice Name Format by going to Settings > Company Settings > Project Accounting.

Invoice dates:

- Date: when the invoice was generated/issued

- Due Date: payment deadline (“Please pay by”)

- Delivery Date: when the services were provided/completed

Usually, the Date and Delivery Date coincide—if that’s the case, most invoices only indicate the Date.

If the Date and Due Date coincide, e.g., June 1, 2022, the invoice is to be paid immediately, also known as “Due on receipt”.

We’ll discuss payment terms later in this guide.

Section #4. Itemized list

There’s a breakdown of all your services and a detailed description, price per unit, quantity, and price.

Each item is then summed up to a subtotal. If you want to add discounts or taxes, these are added to the subtotal, giving you the total amount due.

It’s best to make it as descriptive and concise as you can. First, be descriptive so your clients know what they are getting for their money, but concise so that the invoice fits one page.

Section #5. Notes

Notes usually discuss payment due dates (Net 30 is usually the standard), potential late-payment fees, acceptable payment forms (e.g., cash, bank transfer, credit/debit cards, etc.), exchange rates—if you work with multiple currencies—and most importantly, a thank-you note. Politeness goes a long way. 🙂

Standard pay-by periods are 7, 14, 30, 45, and 60 days. Although the payment due date is stipulated at the top of the invoice, some businesses restate the Net [dd] in the Notes section, meaning “full amount is due for payment in [dd] days.”

For example, Net 10 means that the invoice must be paid within ten days from the date it was issued.

If you’d like to incentivize your clients to pay you ASAP, you can offer them a discount on the invoice or credit towards the next invoice.

For instance, 2/10 NET 30 translates as “get 2% off if you pay within ten days; the payment is otherwise due in 30 days.”

More on NET and payment terms later in this guide.

Discard paper invoices

The problem with paper invoices? They’re so last century, and it has more cons than benefits:

- they’re tedious. Handwriting paper invoices wastes time and can be boring—and an eyesore for clients.

- they’re expensive. A paper invoice costs 5x more than a digital one in terms of time and resources. According to Forbes, in 2020, manually processing an invoice cost $13, while digitally processing one was put at $2.36 on average.

- they’re prone to errors. A badly-drafted paper invoice with inaccuracies can be easily disputed. Plus, there’s the hassle of canceling, correcting, and reissuing an invoice. The error rate for digital invoices is about 1%—almost 4x lower than with paper invoices (Forbes).

- they can delay payment. Paper invoices are slow to deliver and take longer to process. Sending it by mail and expecting cash or checks in return is double trouble and causes great payment friction.

Why do companies use paper invoices? Familiarity. Nevertheless, in light of the COVID-19 pandemic, companies have been undertaking massive endeavors to digitize their business processes—business invoicing included—with 90% of companies resorting to complete digitalization (Pymnts, 2021).

How do you reduce friction in the payment process and save time and money? The answer is—modern invoicing.

Modern invoicing

Modern invoicing ensures and strives toward frictionless payment, making transactions easier by minimizing barriers. Frictionless payment comes in many forms, from digital payment options and gateways, mobile and digital wallets to auto-renewing subscriptions and one-click payments.

Therefore, modern business invoicing must include at least one preferred means of frictionless payment.

What is a digital invoice?

A digital invoice is an invoice that can be generated, viewed, and processed digitally. It is usually a PDF, Word file, or Excel sheet that a human reader understands—it has a visual form—and allows some frictionless payment: a link or QR code with payment details, an online payment gateway, etc.

Businesses can simplify this process by using a QR code generator by Uniqode to embed secure payment links directly into their invoices.

Digital invoices can be generated by dedicated invoicing tools or by exporting Word and Excel files. A digital invoice is sometimes a scanned paper invoice, which can be sent via email to reduce payment delay—although it’s still not ideal to use paper invoices.

What is an electronic invoice?

An electronic invoice (e-invoice) is an invoice that can be viewed and processed digitally. A human reader does not easily understand it, but its main benefit is that it can be processed by a computer thanks to its data format.

An e-invoice is a data file (XML, EDI, or standard Internet-based web forms) containing financial data—think blockchain—transferred between computers, processed, and booked automatically—needing no manual or human input.

An electronic invoice is NOT a scanned paper invoice. An e-invoice is always a digital file—just like a PDF file.

Still, mind the difference—a digital invoice is not necessarily electronic. An electronic invoice is fully digital, while a digital invoice lacks the structured format of the e-invoice.

Still, there’s hope for digital invoices. Using optical recognition (OCR), a computer can process digital invoices using minimal manual work from an administrator or bookkeeper.

Note for EU members: mandatory eInvoicing regulations are gradually being implemented in an effort to increase business transparency with tax authorities, reduce embezzlement and fraud, and lessen bureaucracy. You can read more about the eInvoicing Directive here.

Benefits of modern invoicing

Modern invoicing aims to make fewer human actions (and errors) as time-effective as possible, making payments frictionless.

Digital and electronic invoices are:

- easy to generate and process, thanks to business invoicing tools enabling semi- or fully-automatic workflows.

- easy to track and organize, simplifying accounting and financial duties.

- time-effective: can be generated and sent within minutes.

- cheap: no paper, printing, and postage costs.

- more accurate: human input (and thus errors) is minimized.

- more transparent: fewer chances of fraudulent or duplicate invoices.

- seamless, thanks to varied payment options.

- green, assisting companies in reducing paper waste.

Understanding invoicing terms

Here are some commonly used terms, their meaning, and how they apply to your business. These are relevant to invoicing, and you’ll probably encounter them when using online invoicing software or dealing with clients.

account receivable (AR)

Account receivable (AR) translates as “money to be received”, referring to amounts for goods and services delivered to the client but haven’t been paid yet. Accounts receivable are assets listed on the balance sheet and may serve as credit.

The opposite of accounts receivable is accounts payable (AP), meaning the money you owe other businesses or freelancers. Account payables are liabilities listed on the balance sheet.

billing cycle

A billing cycle (or billing period) is the number of days between two closing dates—the last and current statement date. For example, the number of days between the 10th of the last month (April 2022) and the 10th of the current month (May 2022) is one billing cycle, namely 30 days.

cash flow

As the term suggests, cash flow is the “cash”—not credit, not accounts receivable, but liquidity—that “flows” in and out of your account during a cycle or quarter. Think of all the operations and transactions during a given period—this could mean several or even hundreds of transactions.

Negative cash flow is when you have less money coming in (e.g., a $20,000 project) than money going out through operational costs (e.g., –$25,000). So, the cash flow is negative $5,000 (or –$5,000).

Positive cash flow is when you have more money coming in (from investments, loans, income) than money going out (expenses, operational costs, payroll, taxes). A $20,000 cash inflow and a —$12,000 cash outflow result in a positive $8,000 cash flow.

Is cash flow the same as profit? No. Profit is the money that remains after deducting business costs and taxes. This is why profit boils down to income—not loans or investments. For instance, you can have positive cash flow from getting loans, but that does not mean you have turned a profit.

You can turn a profit while being cash flow negative, which can still be bad for your business. The opposite happens as well—SMBs may have positive cash flow but very little profit to show for it. The best scenario is to ensure constant positive cash flow and steady or growing profit.

Remember that positive cash flow is more important than profit because it ensures businesses go about their daily economic activities. Plus, it’s a sign of financial health.

credit terms

The concept of credit terms is broad, referring to payment terms and requirements. Credit terms usually indicate when the payment is due, whether services are made on credit, if there are discounts applicable, or any interest or late payment fees.

NET [dd] payment

Net [dd] refers to payment terms and deadlines (section #3 of a standard invoice outlined in this guide). For example, Net 30 means the full payment is due no later than 30 days from the invoice date.

Typically, most invoices have 30-day payment terms unless stated otherwise. The most extended payment terms are Net 60, 90, or 120. Shorter pay-by dates are Net 7 and Net 14.

Payment deadlines vary across countries. The US and EU countries have a Net 30, with some exceptions. Northern European countries have shorter Net payments, between 7-30 days, while Mediterranean countries have laxer payment terms. For instance, Spain and France have a Net 45, and Italy and Greece use a Net 50.

Net EOM 10 means “pay the full amount within ten days after the end of the month,” where “EOM” stands for “end of the month.”

Other payment terms: PIA (payment in advance), COD (cash on delivery), CIA (cash in advance), CBD (cash before delivery), 25 MFI (25th of the month following invoice date, where MFI means “month following invoice”).

Net vs. Gross amount

Net and gross refer to the total amount due (section #4 of a standard invoice as outlined in this guide). Net amount should not be confused with Net payment—see above.

A net amount is the cost of products or services before any discounts or taxes—read “Subtotal” on your invoice. A gross amount includes VAT, taxes, and discounts—read “Total.”

Retainer

A retainer is a fee paid upfront for legal and professional services: freelancers, consultants, creatives, advisors, lawyers, etc.

It’s not uncommon for freelancers to ask for “payment in advance” (PIA, for short) or “cash in advance” (CIA) before taking on a project. Retainers protect them against non-payments and uncollectibles or cover the project’s initial expenses.

A retainer is not a deposit. The difference is that a retainer is non-refundable, while a deposit is returned when the services are completed.

Is a retainer the same as a down payment? Yes, since both are non-refundable.

Quote

Known as a quotation, sales quote, or price quote, a quote is an estimate of the rates, services, and total cost of a project. A quote offers a fixed price, which is agreed upon by both parties. It is usually valid for 30 days before it can be renegotiated.

A quote is more exact than an estimate, giving clients a rough idea of the price, which may change. That’s why an estimate will never be legally binding.

Is a quote the same as an invoice? No. Timing is the key differentiator—a quote is sent before the project starts, while an invoice is sent after project completion.

Although a quote is not an invoice per se, it can be turned into one with a few clicks if you’re using business invoicing software. The total amount paid is usually the same as the initial quote.

Proforma

A proforma invoice looks like an invoice but acts as a quote. It is sent before work begins as an agreement between the client and the provider. Then, the client can decide whether to proceed with the business deal or negotiate the scope, services, or prices.

How to generate and send an invoice

Use Invoicing software

An invoicing tool is a major step up from typing up Word documents and Excel spreadsheets. Nowadays, business invoicing comes in many sizes, from a standalone product to a robust module within a project management platform.

Tip: Try out one of the best free invoicing software on the market—Paymo has recently updated and improved its invoicing module, offering project partial invoicing and various advanced features.

There’s really no turning away from modern invoicing—it’s time freelancers, businesses, and enterprises adopted online invoicing software to help them process payments and keep track of their financial statements.

Bonus: Consider using a mobile app so you can invoice on the go from your phone.

Overview of an invoice in Paymo: in-app and PDF file.

What’s great about project management software with business invoicing is that besides the much-needed expense management and invoice generation, you have all the tools you need in one place to carry out your work.

How does it work in Paymo?

- Set up a meeting with your client and initiate the desired project.

- Agree on the scope, budget, and time constraints.

- Send an estimate to your client.

- Start working on each task while keeping track of your time.

- Generate static or live reports and share them whenever necessary to keep your client in the loop. You can have them join as Guest Users for extra oversight.

- Deliver the end product or services.

- Generate an invoice based on the outstanding tasks or time tracked.

- Get paid through online payment gateways or other frictionless payment options.

Paymo’s Dashboard gives you an overview of your accounts receivable, billable hours, top clients, unpaid balance, a chart on payment status, and total invoices sent.

In Paymo’s Accounting module, there are four tabs—Invoices, Estimates, Recurring, and Expenses. So, let’s set up a step-by-step process:

Before you dive into work

- Discuss your terms and policies beforehand. Now that you understand invoicing concepts, payment terms, and how invoices work, set up a system for yourself. Be clear on your preferred payment methods, deadlines, and whether you require a retainer fee. Also, get your client’s contact information.

- Agree on a payment schedule. If you can help it, make sure it is mutually beneficial. You want to foster a good business relationship, so hear your client out—if Net EOM 10 works better for your client than your standard Net 30 and it doesn’t break your bank, go for it. Chances are that your client will appreciate your goodwill. Also, see whether a 2/10 Net 30 makes sense so that you give your client a nudge.

- Establish your preferred payment methods. There are various acceptable payment forms: cash, checks, standing orders, credit and debit cards, bank transfers, internet banking, etc. Still, decide which payment methods are the most efficient and see whether your client can comply. Make it super easy for your clients to pay you by providing various payment methods. Take into account that many banks now offer debit cards for teens and young adults with different regulations. Most invoicing tools have online payment gateways so that clients can pay you in a few clicks directly from the invoice.

- Discuss late payment fees. If 2/10 Net 30 is the carrot, then interest fees are the stick. Be upfront about charging late payment fees and when they apply. Late payment fees create a sense of urgency since nobody wants to be charged a fee. Interest rates for late payments usually range between 1.5% and 3% per month—but there’s a maximum annual interest rate depending on the state. In Europe, there’s a €40 fee per invoice after 60 days of non-payment. It is best to discuss late fee charges beforehand—this way, your client has been advised.

- Set up payment reminders. Invoicing services keep track of everything for you—with Paymo, you can send friendly reminders to your clients in case they haven’t paid the amount due. You can customize the frequency between reminders.

Enable and customize late payment reminders in Project Accounting.

After work is done

1. Generate the invoice in Paymo. An invoice is created in a matter of minutes. Here is a quick tutorial on how to create an invoice in Paymo, or watch the video below:

2. Add a thank-you note. A short “thank you for your business” and “please pay within 30 days” do not go unnoticed.

3. Proofread your invoice. To err is human—take a couple of minutes to review the information on your invoice. First, check the client info, then the total amount, and double-check your banking information. Triple-check if you must. Many invoices remain unpaid due to avoidable errors.

4. Send or share the invoice. Send the invoice via email or permalink—as a PDF file— or share it in-app so that Guest Users can view it and process the payment.

5. Accepting payment. Thanks to digital and electronic invoices, online payments have been the preferred option for most companies. Providers have been paid faster and with more ease. Sure, online payment gateways charge a small processing fee for each transaction. But if you factor in the seamless process and time saved in administration and bookkeeping, the small fee is insignificant.

Mistakes to avoid when invoicing

1. Putting off sending invoices

Once the job is done, send the invoice that same day. Statistics show that if you bill your client the day the services are provided, you are almost 1.5x more likely to get paid.

If you wait until the end of the month, then you’re giving your client another month to pay you—which may disrupt your cash flow.

2. Getting the wrong information

Make sure you did not misspell the email address, the company name, or mistype the total amount due. Mistakes like these are embarrassing and may delay payments.

3. Sending the invoice to the wrong person

If your client is another company, check in with their financial or accounting department. You probably won’t send the invoice to the project’s liaison or manager.

4. Generating a vague invoice

Be explicit and detailed when writing the itemized list of services—if you’re doing it manually. Don’t give the client any excuse for disputing the invoice.

5. Providing incorrect payment information

Make sure you send the correct link for payment and write the correct bank account number, contact info, and mailing address. There are fewer errors if clients can pay via online payment gateways.

6. Reusing invoice numbers

It’s a good rule of thumb to number your invoices sequentially. Each invoice must have a unique reference number. So if you cancel or write off a VAT invoice, don’t re-use its number, even if you don’t want inconsistencies in your numbering.

Why? Because the canceled or written-off invoice must remain in your records, should you need them in case of an audit.

7. Forgetting to include your correct GST/VAT number

If your clients need to reclaim VAT on your invoices, you must add your business’ VAT number. While the invoice isn’t invalid, it may aggravate your clients and their cash flow if you don’t include the VAT number.

8. Failing to follow-up

You’ve done the work and sent the invoice months ago, which is way past due. Don’t feel embarrassed to send your client a friendly reminder—or do it automatically in Paymo—that the invoice is past due and that interest fees have accrued.

9. Using tacky and unprofessional invoices

Go with a consistent and professional design because—to be honest—the design matters. A terrible color scheme and illegible fonts can cause confusion and frustration. When in doubt, keep it simple. But you don’t want it bland either—you want a design that reflects your brand.

Your logo is a must—it exudes professionalism and credibility. In Paymo, you can customize your invoices by editing existing templates with HTML/CSS.

10. Not using the right kind of invoice

There are different types of invoices, although some vary just a little.

For example, a sales invoice is an invoice you send—a purchase invoice is an invoice you receive. In theory, the content of that same invoice does not change. Or a tax invoice is any invoice that includes GST or VAT.

For businesses dealing with domestic goods and services:

- Proposal/Bid/Pro Forma. A proforma (proposal) is an estimate sent so the client knows how much you will charge for your goods or services. Caveat: in some countries, a proforma invoice is a binding commitment—it is sent to a customer so that it can be paid before or on delivery.

- Interim Invoice. Interim invoices are sent weekly or monthly during a project spanning months or years. It usually applies to lengthy and expensive projects to offer incremental payment to ensure good cash flow. Interim invoices are similar to progress invoices.

- Progress Invoice. Commonplace in the digital industries, progress invoicing charges clients incrementally for work completed since projects can stretch out over many months.

- Final Invoice. It is sent after completing a project and is the last one in a series of interim invoices.

- Recurring Invoice. Not an interim invoice—a recurring invoice is sent automatically for the same customers on a specified date. This is only possible using a digital invoicing tool. Think of monthly subscriptions that are generated on a cyclical basis.

- Past Due Invoice. It is an invoice sent if the account is past due. A past-due invoice includes the original invoice plus the interest accrued (e.g., penalty).

For businesses dealing with international transactions, e.g., imported-exported goods:

- Commercial Invoice. An invoice is required by customs to establish the value of imported goods needed to appraise taxes and duty fees. A commercial invoice carries information like total units, total declared value, country of origin, transportation costs, etc.

- Customs Invoice. A type of commercial invoice, the commercial invoice requires additional customs terms.

- Consular Invoice. A type of commercial invoice, the consular invoice is visaed by the consul of the importing country (e.g., US) resident in the exporting country (e.g., Germany).

How to correct an invoice after you sent it

Mishaps can happen. What do you do?

If you’ve sent an incorrect invoice, you must issue a cancellation invoice with a new one—don’t reuse the old one. However, you must include the old number in the cancellation invoice under Notes and a negative invoice amount and date of issue.

Then, send the correct invoice with a new number—in the Notes section, you may add the reference number for clarity.

What are voided invoices?

A void invoice is a canceled invoice that exists as a transaction but does not impact your financial records. By voiding it with a simple click (“Mark as void”), you keep it in your records, not affecting your numbering sequence.

Why should you void an invoice? If there was indeed an error, you could void it as long as your client hasn’t paid you—partially or in full. Deleting an invoice is irreversible and not recommended because it is removed from your records, leaving gaps in your invoice number sequence.

Voiding an invoice is one way of dealing with accounts uncollectible or bad debt. This leads us to the last section of this guide:

How to get paid when they won’t pay you

A study on the UK market shows that the average small business is owed £8,500 at any given time, and freelancers a little under £1,000. One in two freelancers have uncollectible unpaid invoices, and one in four freelancers admit to having kept working with bad clients.

Please know that if you’ve delivered the work under agreement, completed the services in good faith, and your client was aware of your terms, you are entitled to chase late payments.

What happens when your accounts receivable or business invoices haven’t been paid or become uncollectible? You have a few options:

- Write it off/void the invoice if you can’t be bothered about the small sum. Sometimes, it’s not worth paying for a solicitor or debt collection agency if the sum is minimal.

- Persuade your client. Communication is key. Try to settle the issue politely in an informal setting. See whether there is good faith and whether you can break up the invoice into smaller interim invoices. See whether the invoice reached the right person, etc.

- Seek legal advice. A solicitor will send a formal letter to your client on your behalf, which might scare your client in the right direction to pay you ASAP. Usually, the fear of legal action can speed up the late payment process. If not:

- Take it to the small claims court. Depending on the state, the amount due must be between $2,500 to $15,000 to take it to a small claims court. You’ll have to take it to court if it exceeds the maximum limit. Make sure you have a good case, confident that the judge will rule in your favor. If you work in the EU, please refer to the Late Payment Directive.

- Contract debt collection services. Find a good agency that uses legal means to recover your debt. You’ll have to provide the original signed contract, any quotes, estimates, unpaid invoices, proof of work (reports, timesheets), and proof of communication.

Before you chase nonpayments/late payments

Make sure you assess the situation right—you don’t want to ruin your business relationship if the error is on your part. Check for the following:

- Did you send it to the right email address/client?

- Was the client aware of your payment terms, including late fees?

- Did you send it to the right department?

- Was the invoice correct?

- Did you read the due date right?

- Did you send the correct payment methods or business details?

- Was there an accounting error on your part while keeping track of transactions?

- Did your invoice get lost?

In Paymo—you know whether the client has read/viewed/opened the invoice. Plus, you can share the permalink and send notifications after a set amount of days.

If you did your due diligence and the error is not on your part, go ahead and chase the late payment. You’re entitled to get paid fairly for your work, regardless of whether your client is taking advantage of your work or not.

How to avoid a bad client

While there’s always a risk when doing business with a new client, you can research the prospective client or undertake a credit risk assessment.

Look them up online. Do they have good reviews on work platforms or forums?

Ask around. Do your business peers or fellow freelancers know this client or company? Does it have a good reputation? Do they have a good track record of business transactions?

And most importantly, do they know what they need from you? Is the negotiation going well? Are they trying to make lowball offers or trick you into agreeing to lower rates?

While there’s no sure way to avoid all bad clients, these are red flags to remember when agreeing to a project.

Takeaway

Business invoicing may look daunting at first. But trust me—you’ll want to remain in charge of your invoices for small business once you get the hang of it. Plus, you’ll feel great when those invoices get paid, and your cash flow is positive.

If you’re managing your invoices in Paymo, your Dashboard gives you a bird’s-eye view of your finances.

Revisit this guide as many times as necessary. I hope these steps, tips, and insights help you create your own process that’s consistent and efficient for you and your business.

Alexandra Martin

Author

Drawing from a background in cognitive linguistics and armed with 10+ years of content writing experience, Alexandra Martin combines her expertise with a newfound interest in productivity and project management. In her spare time, she dabbles in all things creative.